Fraud Avoid

Use Cases

Fraud Avoid

Use Cases

Top-Notch Technology for Unparalleled Protection

We're committed to the ongoing enhancement of our technology and services to stay ahead of emerging threats.

Continuous Updates

Our methodology enables us to identify expert spoofers and recurrent offenders with precision.

Exclusive Fraud Detection

All our plans come with a guarantee of uninterrupted performance, backed by an SLA Uptime of over 99.99%.

Reliability Guaranteed

Our solutions are designed to accommodate your growing operations without constraints.

AutoScale Software

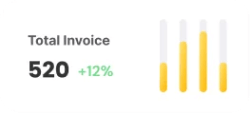

With a latency of less than 10ms, our high-speed performance ensures seamless operations with minimal delay.

Industry-Leading Latency

Our solution is engineered to outperform even the most sophisticated AI, including GANs (Generative Adversarial Networks).

AI Beats an AI

Protecting Payment Gateways:

Strengthening Customer Relationships

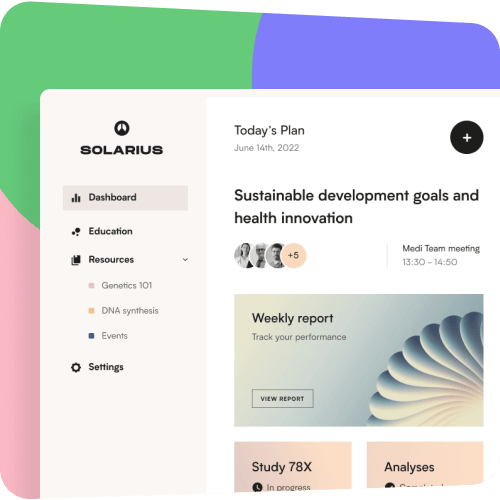

One of the key strengths of FraudAvoid lies in its ability to fortify payment gateways, acting as a formidable barrier against fraudulent transactions. By implementing this cutting-edge solution, businesses can significantly lower their refund rates. The system's robust algorithms detect and block payments made with stolen cards or compromised credentials, thereby preserving the integrity of your transactions.

Moreover, FraudAvoid reduces the need for labour-intensive manual reviews, optimising your resources. It provides crucial data directly to your analyst or fraud manager through an intuitive dashboard, streamlining decision-making processes. By combining factors such as email strength, IP, device information, and behavioural analysis with machine learning, FraudAvoid empowers businesses with unparalleled insights and reporting capabilities.

Identifying Fraudulent Traders:

Unmasking High-Risk Behaviour

One of the standout features of FraudAvoid is its proficiency in automatically identifying and flagging high-risk traders. Through meticulous digital trace analysis, the system creates comprehensive customer profiles, enabling businesses to filter out suspicious behaviour effectively. By leveraging the power of machine learning, FraudAvoid ensures that poor customers and payments made with stolen cards are swiftly identified, safeguarding your revenue streams.

Satisfied Users Speak

John Smith

Founder & Director“"We send traffic to some of the most demanding and sensitive partners in the industry and rely on FraudAvoid to filter poor clicks. Using FraudAvoid has pushed our ROI up to 8%."”

Eh Jewel

Marketing Manager“"We took our partnership with cellular operators very seriously. FraudAvoid analyses our traffic in real-time, allows us to trim cheats before they produce fake conversions for our customers”

Mark Tony

Growth Director“FraudAvoid is pivotal for customer acquisition strategy. Its implementation led to fewer fraudulent acquisitions and a substantial rise in customer engagement.”

A Multifaceted Approach

Fraud Avoid serves as a formidable shield against a multitude of fraudulent activities, including:

- Identity Theft

- Synthetic Identity Creation

- Account Farming

- Reversed Payments

- Refunds and Chargebacks

- Account Takeover

- Bot Attacks

- Disputed Payments

- Friendly Fraud

- Regulatory Fines

Conclusion

A Shield Against Fraud, an Asset to Your Business

In an era where cyber threats bloom large, FraudAvoid stands as an indispensable tool for businesses across industries. Its multifaceted approach to fraud prevention, coupled with advanced machine learning capabilities, ensures that your organisation remains resilient in the face of evolving threats.

With FraudAvoid, you not only protect your revenue streams but also fortify customer trust and satisfaction. Embrace this powerful anti-fraud solution and elevate your business to new heights of security and success.